These could include direct materials, labor, and other relevant costs directly tied to the production. If avoiding these costs saves more money than what is earned from sales, they might stop selling that item. Differential cost, simply put, is the difference in total cost when considering two different options.

Usage of Differential Cost Analysis

In these situations, the management should select thealternative that results in the greatest positive differencebetween future revenues and expenses (costs). The incremental revenue of Rs. 10,000 is much more than the differential cost of Rs. 3,000, it will increase the profit by Rs. 7,000. Managers also consider differential cost for equipment choices. Two machines might do the same job but have different maintenance and operation costs over time – these are indirect variable and fixed expenses related to running them each day. Unlike variable or marginal costs that adapt to activity levels, fixed expenses provide stability in financial planning but also pose a challenge during slow periods when revenues may not cover all operating costs.

Raw Material 1

- The differential costs can be fixed, variable, or semi-variable costs.

- The first proposal results into a loss and hence is not acceptable.

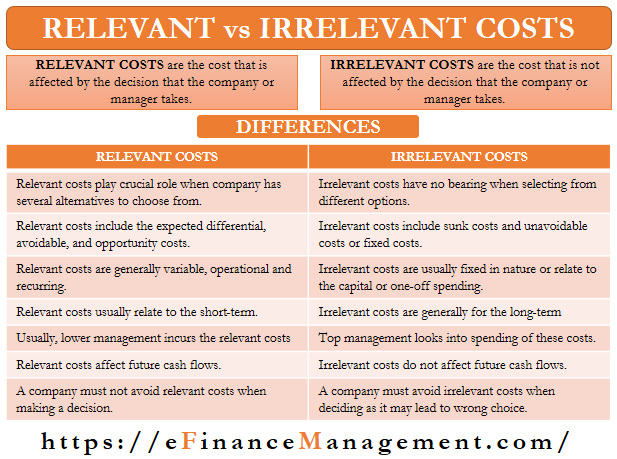

- Differential cost refers to the difference in total costs between two alternatives, encompassing all relevant costs that change as a result of the decision.

- Making the right choice between two products involves a close look at differential costs.

- Differential cost is the same as incremental cost and marginal cost.

Our blog dives into the nuts and bolts of differential costs, helping you distinguish between variable, fixed, and semi-variable expenses. With real-life examples and clear explanations on types and analysis methods, we’ll guide you through using this powerful tool for sharper decision-making. Differential cost is the same as incremental cost and marginal cost. The difference in revenues resulting from two decisions is called differential revenue.

Raw Material 2

In practice, businesses often use both differential and incremental cost analyses to gain a comprehensive understanding of their financial landscape. While differential cost analysis provides a broad view of the financial implications of different strategic options, incremental cost analysis offers granular insights into the specific costs of scaling operations. By integrating both approaches, companies can make more informed decisions that balance long-term strategic goals with immediate operational needs. The raw material price and the direct labor cost both make a difference, so both of these costs would be relevant as you looked at your options.

Difference between Marginal and Differential Costing

By breaking down mixed costs into their fixed and variable components, businesses can better understand how these costs will change with different levels of activity and make more informed decisions. In forecasting, differential cost analysis helps businesses anticipate future financial performance under different conditions. By modeling various scenarios, such as changes in raw material prices or shifts in consumer demand, companies can better prepare for potential fluctuations. This proactive approach enables businesses to develop contingency plans and adjust their strategies in response to changing market conditions. For example, a company might use differential cost analysis to forecast the impact of a potential tariff on imported goods, allowing it to explore alternative sourcing options and mitigate financial risks.

Differential Costs

Company executives must choose between options, but the decision should be made after considering the opportunity cost of not obtaining the benefits offered by the option not chosen. For example, difference in costs may arise because of replacement of labour by machinery and difference in costs of two alternative courses of action will be the differential cost. Companies do not record opportunity costs in theaccounting records because they are the costs of not following acertain alternative. Thus, opportunity costs are not transactionsthat occurred but that did not occur. However, opportunity cost isa relevant cost in many decisions because it represents a realsacrifice when one alternative is chosen instead of another. The total cost figures are considered for differential costing and not the cost per unit.

Understanding fixed costs is essential for any accounting professional. They form an integral part of direct costs and indirect overheads in financial statements. Businesses must cover these ongoing expenses to keep their operations running smoothly. Opportunity cost refers to potential benefits or incomes that are foregone by choosing one option over another.

If Bennett worksat the stable, she would still have the tiller, which she couldloan to her parents and friends at no charge. Differential costs do not find a place in the accounting records. These can be determined from the analysis of routine accounting records. All in all, managers often get into situations, where they have to choose from alternatives. Differential Costing is helpful in a comparative evaluation of the substitutes available.

An example is a utility bill that has a fixed base charge plus a variable charge based on usage. For instance, a manufacturing plant may have a fixed monthly electricity charge plus additional costs that vary with production levels. Analyzing mixed costs can be more complex due to their dual nature, but it is essential for accurate differential cost analysis.

Differential costs are the increase or decrease in total costs that result from producing additional or fewer units or from the adoption of an alternative course of action. The primary purpose of conducting a differential analysis is decision-making. So, we consider only relevant costs affecting the decision variables. Semi-variable expenses blend features of both fixed and variable costs.

Prepare differential cost analysis to ascertain acceptance or rejection of the order. A Statement of Differential Cost and Revenue is prepared to perform differential costing. The costs that do not change in the alternatives are not part of the analysis. Consider a company engaged in plastic bag what is an amazon resource name arn definition from searchaws manufacturing that acquires an advanced machine to double its current production of plastic bags. As soon as the company puts the new machine into use, the government bans the manufacturing of plastic bags in the country and makes it a crime for any person to manufacture or sell plastic bags.