It was agreed that he should be paid a salary of $10,000 per annum from that date. Accounting Treatment – Interest on drawings is profit or gain to the Firm and credited to the Profit& Loss Appropriation Account. On the other hand, interest on drawings is a loss to the partner and debits to his Current/Capitals Account.

Statements for partnerships

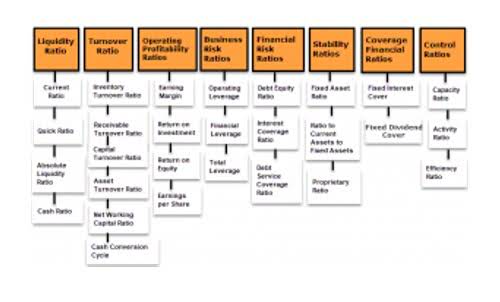

When company Charge Interest on Drawing – Interest on Drawings will be charged from the partners if the partnership agreement provides for the same. If partnership deed is silent about charging interest on drawings, No interest on Drawings will charge. Limited liability partnerships (LLPs) are a common structure for professionals, such as accountants, lawyers, and architects. This arrangement limits partners’ personal liability so that, for example, if one partner is sued for malpractice, the assets of other partners are not at risk.

Capital accounting

Write up the partners’ current accounts for the year ended 31 March 20X3(3 marks) (12 marks in total). (a) One partner may guarantee that another partner’s total profit share is not less than a certain minimum amount. To deal with this, make a transfer from one column to another in the tabulated statement.(b) Changes to the profit-sharing arrangements or changes in partnership personnel part way through the year. You have to divide the profit on a time basis between the periods, then apply the details given to the apportioned profits. What you have to realise is that for the partners not bearing the expense, the profit is that shown by the income statement plus the special expense.

The Role of Monthly Accruals in Modern Accounting Practices

This is a debit entry for the value of the goodwill in the goodwill account. The double entry is completed with credit entries in the old partners’ capital accounts. The value of each entry is calculated by sharing the value of the goodwill between the partners in the old profit or loss sharing ratio.

The result is capital balances of the partners at the end of the accounting period. The last twoentries are different because there is more than one equity accountand more than one drawing account. A key difference is derived from partnership account the basic definitions of ‘sole trader’ and ‘partnership’. Therefore, there is only one owner of the business, and all of the profit earned by the business belongs to the owner. Consequently, the income statement is closed off by the transfer of profit to the owner’s capital account. Partnership accounting is a specialized area of financial management that requires careful attention to detail and an understanding of unique principles.

- These CDs are best for those looking to lock in high rates for the long term.

- Properly managing these tax documents is crucial to ensure compliance and avoid penalties.

- For example, the partners may have differing degrees of involvement, or may bring specific skills to the business.

- The partnership must also settle any outstanding debts and obligations, which may involve negotiating with creditors or restructuring payment terms.

- Paying interest on capital is a means of rewarding partners for investing funds in the partnership as opposed to alternative investments.

- Partnership accounting is a specialized area of financial management that requires careful attention to detail and an understanding of unique principles.

- At least one partner must be a general partner, with full personal liability for the partnership’s debts.

- When company Charge Interest on Drawing – Interest on Drawings will be charged from the partners if the partnership agreement provides for the same.

- This step is crucial to ensure that the new partner aligns with the partnership’s vision and values, thereby minimizing the risk of future conflicts.

- If a partner is entitled to a salary, it is dealt with as part of the appropriation of profit.

- Six-month CDs are best for those who are looking for elevated rates on their savings for short-term gains, but are uncomfortable having limited access to their cash in the long term.

The dynamics of a partnership can change significantly with the admission or withdrawal of partners, making these processes pivotal moments in the life of a business. When a new partner is admitted, it often brings fresh capital, new skills, and additional resources to the partnership. However, this also necessitates a re-evaluation of the existing partnership agreement to accommodate the new partner’s role, responsibilities, and share fixed assets of profits and losses. The incoming partner typically buys into the partnership by contributing assets or cash, which is then added to their capital account. This infusion can be a strategic move to bolster the partnership’s financial health or to bring in expertise that complements the existing partners’ skills.

There are, however, differences in the laws governing them https://www.bookstime.com/ in each jurisdiction. Like any business structure, a partnership comes with both benefits and drawbacks. When a new partner is admitted to the partnership, the new partner effectively buys the assets of the old partnership from the old partners. Depending on what the question is testing, it will either provide the amounts of interest on capital and drawings or give details of how to calculate the amounts.