Exchange Communications

And although the SEC, trading courses and common sense warn that day traders should put at risk only that money which they can afford to lose, the reality is such that they make huge losses using the borrowed funds or by means of margin trades or due to ‘borrowing’ from the family budget or other sources. Trusted by over 2 Cr+ clients, Angel One is one of India’s leadingretail full service broking houses. The point is to keep your balance stable. In this article, we will look at the differences between two trading platforms: MetaTrader 4 MT4 and MetaTrader 5 MT5. Also read: Forex reversal patterns. They can provide clues as to the future direction of prices, as they often indicate that buyers or sellers are gaining or losing control of the market. The size of a tick can influence your behaviour and decision making process in several ways. A score of 20 or under shows oversold market conditions, which is a buy signal. CFDs are complex instruments. Good thing i only deposited 10usd for this trial. Wolfinger, who spent more than 20 years on the floor of the Chicago Board Options Exchange CBOE. Let’s walk through a straightforward algorithmic trading example. Paper Trading Executions. Consider reading it if you want to trade in options using any of the four strategies. Intraday Trading Indicator: When it comes to booking profits in intraday trading, you must conduct an extensive study.

About the Editorial Team

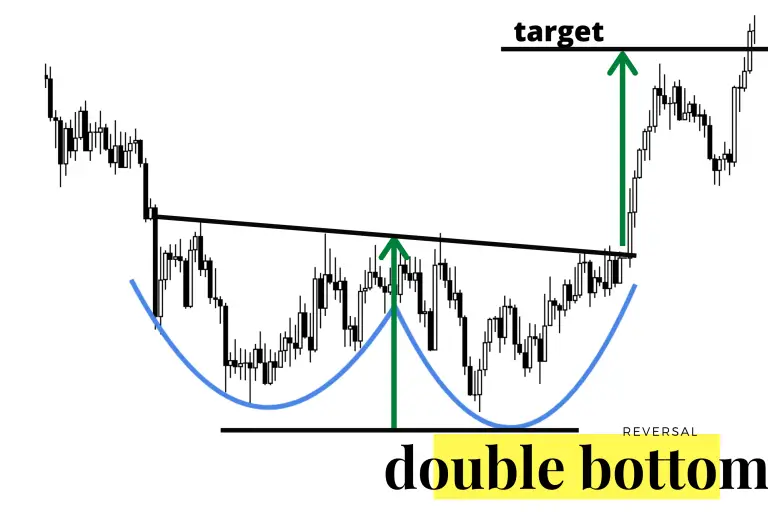

Brokerage fees are important, but many often forget about currency exchange fees. Shooting https://www.pocket-option-guides.website/ star candlestick pattern trading example. More information is available via our links to Wealthfront Advisers. NSE/INSP/27346, BSE : Notice 20140822 30. Triple tops and bottoms are identical to double tops and bottoms; however, instead of failing to break the previous high or low just once, it fails to break it twice. Now that almost all stock apps offer free stock trading, we recommend comparing other features to choose the best stock trading app. Exchanges often have a wide range of cryptocurrencies available and allow for greater control over the buying and selling process. Mandatory details for filling complaints on SCORES i Name, PAN, Address, Mobile Number, E mail ID C. Read this article to know more about the types of indicators and the significance of each indicator. Fast execution platforms and real time data are also essential. Find out more about IG’s APIs, which enable you to get live market data, view historical prices and execute trades. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. From our website, you can download any colour trading apk for free. Define and write down the specific conditions under which you’ll enter a position. If not, perhaps you can cut costs by starting your business as a side hustle, launching online, or trying a pop up store instead of a permanent location. Use limited data to select advertising. Proper due diligence has been done for the images and the image is not of any artist.

What’s on this page?

This approach helps protect your capital, allowing you to trade another day even after a series of losses. Use profiles to select personalised content. Today, due to mechanisms like retail price improvement and dark pools, customers often see stock fills at sub penny increments. It would save you lots of money in the long run. Day traders love TradeStation as a trading platform our editorial team chose it as the best day trading platform in 2024, which comes with a free trading simulator. It is performed intraday. Become a PRO really fast. Another key tip to keep in mind is developing financial literacy and knowing the trading terms and market jargon used. Firstrade scored well for penny stock trading in our 2024 Annual Awards, and is a great choice for Chinese speaking investors. In addition to creating a trade account format, you can also create expense reports. Given below is the Trial Balance of M/s Roma and Mona partnership firm. Each type of intraday trading requires a different approach and skill set. They may only spend a few hours per week studying potential trade set ups and identifying entry and exit prices. You only need to deposit a minimum of $1 and deposits are free too – so far so good. Access our full range of products, CFD trading tools and features on our award winning platform. Driven by an increase in food inflation, the overall retail inflation in August rose in both rural and urban areas, though it’s the ‘second lowest’ in five years. Options are considered derivatives because they derive their value from the price of another asset, called the underlying asset. At an individual level, experienced proprietary traders and quants use algorithmic trading. Traders might choose which is the most appropriate chart type based on their trading objectives, timeframes, as well as market conditions. Be informed about the selected companies, their stocks, and general markets. Following is the format mentioned in Schedule III – STATEMENT OF PROFIT and LOSS. Cryptocurrency services are offered through Robinhood Crypto, LLC “RHC” NMLS ID: 1702840. This is the “WTF, TradingView. We support the following order types. Maybe Germany or Australia. Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Benefit from our expert faculty, comprised of experienced traders and analysts from major financial companies including HSBC and Bloomberg. The money contributed by the shareholders is referred to as capital or equity. If you’re a skilled typist and have an excellent ear for what people are saying, transcription could be the small business idea for you. Hence, emotional stability and discipline are what separate the profitable traders from the amateurs.

7 Stochastic Oscillator

In the real estate market, call options have long been used to assemble large parcels of land from separate owners; e. Splashes of adrenaline from fast trading is an important factor in your decision to make a living by scalping. Pay minimum 20% upfront margin of the transaction value to trade in cash market segment. If ABC shares trade above $25 at that date and time, the trader receives a payout per the terms agreed. Steve Nison’s “Japanese Candlestick Charting Techniques” is an introduction to the ancient Japanese technique of candlestick charting. For example, the EUR/USD pair may have a 1. WeWork Galaxy, 43, Residency Rd,Shanthala Nagar, Ashok Nagar,Bengaluru 560025. They can guide your skill development and demonstrate techniques you can’t learn any other way. Don’t hesitate to tell us about a ticker we should know about, market news or financial education. But as the industry has evolved, the U. Rokadimal of Rajkot and Gunjal of Pune, entered into a Joint Venture to purchase and sale goods and agreed to share profit and losses in the proportion of 4 : 1 respectively. Use automated tools to invest regularly. Your capital is at risk. This sort of approach can quickly spiral out of control, causing a trader to suffer sharp losses and potentially rack up a significant amount of trading fees. Outline exactly what you hope to achieve. Algomojo Supports Tradingview, ChartInk, Amibroker, Ninjatrader, MT4, MT5, Excel, Google Sheet, Google Chrome Extension, Python, and C based Applications. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test. Mastering the position of a stock trader and learning how to trade stocks can be an exciting and challenging experience. See a list of frequently compared brokers and compare more before choosing. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. Can I buy a call and a put on the same stock. Effective risk management involves setting appropriate stop loss levels and determining position sizes. Enjoy up to 5% back on all spending with your sleek, pure metal card. Apple iOS and Android. Should such a situation occur, your closed positions during the first session will be reopened after which you will need to exit the position again in the second session. The opposite is true for put options. This balance accrues interest until it’s repaid, reducing the buying power of the investor.

2 Set Aside Funds

But that doesn’t mean you’re alone either. The images used are only for representation purpose. When this happens, it is usually an indication that a new upward trend is starting. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank and Trust pursuant to a license from MasterCard International Inc. In sample testing and out of sample backtesting is a method where you divide your backtesting data into two parts. Use limited data to select content. Traders can choose to trade and invest in a wide range of companies on the US stock market, including well known brands such as Apple, Amazon, and Tesla. Earn up to 3% extra on annual contributions with Robinhood Gold Get 1% extra without Robinhood Gold, every year. Cryptocurrency markets move according to supply and demand. Is licensed and regulated by the Monetary Authority of Singapore Licence No. On the other hand, investors prefer free equity delivery. Check out Vanguard to invest at affordable prices over the long term. Forex is always traded in pairs which means that you’re selling one to buy another.

GTF OPTIONS LIVE

You’ll also hear from our trading experts and your favorite TraderTV. Sometimes, they may overlap day or positional trading. Margin trading is when you put down a deposit to open a position with a much larger market exposure. Exchanges provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. But if you have good general knowledge, you can solve them quickly. In my personal experience, a demo trading account is a great place to get started. Where XTB falls behind is in the area of social trading, where offerings are limited. Central banks also control the base interest rate for an economy. Mandatory details for filing complaints on SCORES. To Non operating expenses. 7 Best Performing ESG ETFs. Instead, it relies heavily on the social aspect of trading, connecting you with a wider community of traders to give you a much more inclusive experience. While to become a skilled forex trader who can conquer the market takes a substantial amount of experience, the possibilities of investing and making billions become achievable. Maintaining objectivity in trading psychology requires traders to ground their choices in facts rather than emotions, thereby eschewing personal biases for a neutral stance on each trade. Charts are also interactive, with pinch and zoom options. For instance, heavy and clustered buying from company insiders may indicate that promoters are confident about the business prospects and they feel that the stock is undervalued. Nearly 100 years later, it’s an approach still used by successful traders and one echoed by the many interviewees in Schwager’s book. The platform stands out for an easy to use interface that makes one time or recurring crypto transactions a snap. If you have questions, are aware of suspicious activities, or believe you have been defrauded, please contact the CFTC immediately. It is a report sheet that requires total assets to match total liabilities + shareholder capital. Select a trading platform: Various trading apps like Zerodha Kite allow trading in the stock market. As with all securities, trading options entails the risk of the option’s value changing over time. Below is a chart with an additional example, and you can see the profit/loss changes as you move your cursor along the line.

Trading for beginners: where to learn more

But you’ll have to do so much more: analyze the company’s management team, evaluate its competitive advantages, study its financials, including its balance sheet and income statement. Analyze historical data, live updates, and expiry dates with user frien. The RSI can be very helpful when used on tick charts for day trading and during periods with increased trading activity. Adequate cash is required for day traders who intend to use leverage in margin accounts. StoxBox is at the forefront of revolutionising zero brokerage trading in India. Enjoy a user friendly platform with a low barrier to entry in terms of experience, and trading itself is quite slick and intuitive. This information has been prepared by IG, a trading name of IG Markets Limited. In addition, we’ll look at the variety of technical indicators swing traders master to make judgement calls on whether it’s worth going long or short on an asset. You can calculate options pricing using two different models. I find the IG Trading app to be easy to use and jam packed with powerful features and intuitive trading tools. Fortunately, there are many different options available. We’re a regulated online broker.

EMPLOYEES and PARTNERS

Swing trading is a type of trading in which positions are held for a few days or weeks in order to capture short to medium term profits in financial securities. The key principle behind this strategy is to capitalise on market inefficiencies, seeking to exploit even the smallest price differences. The red and green bars indicate the OI for a particular strike price of calls and puts. A scalper does this with the sole aim of earning profit during a short term price fluctuation. While not the most extensive compared to some other brokers, it still caters to a variety of needs. Your plan should specify your entry and exit criteria, how much capital you will risk on each trade, and your overall risk management strategy. Then, the movement begins to pick up again toward the closing bell. Because of the ultra narrow time frame, day traders often aim to capture smaller gains more frequently—unless they’re trading a major news event or economic release, which can cause an asset to skyrocket or nosedive. What are the disadvantages of using an investing app to trade stocks. Customer support is another strong point for AvaTrade. Save my name, email, and website in this browser for the next time I comment. So just because it’s free doesn’t mean it’s better. Westend61 / Getty Images. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. For all of these patterns, you can take a position with CFDs.

What are the hours of operation?

These are the platforms used by expert traders, making it necessary to master them early. Trades of stocks, ETFs and options are commission free at Robinhood Financial LLC. The 1 hour, 4 hour and daily time frames tend to provide a good balance between seeing the overall market structure and spotting potential trade setups. They’re always quick torespond, super helpful, and care about sorting out any problemsyou might have. Fundamentals tend not to shift within a single day. You can find plenty that cost little to no cash to launch. With derivatives trading, you can go long or short – meaning you can make a profit if that market’s price rises or falls, as long as you predict it correctly. 1 Stock on 31st March, 2012 was valued at Rs 80,000. For example, it cannot be accessed in Luhansk, Iran, Crimea, Cuba, Donetsk, Syria, and North Korea. Unleash the power of generative AI. Virtually all professional traders started with zero industry knowledge or skills and simply decided to get started. After finding a viable product and strategy, it’s time to secure market share. Measure advertising performance. Prevent unauthorized transactions in your account Update your mobile numbers/email IDs with your stock brokers. The Impact app focuses on ESG environmental, social and governance investing. Over the counter derivatives are complex instruments and come with a high risk of losing substantially more than your initial investment rapidly due to leverage.

Stock Research

Additionally, the nature of the candles can tell us when to enter with tight risk. So, it is better to start with the right decision directly. The content on this page is not intended for UK customers. Margin trading involves a high level of risk and is not suitable for all investors. INZ000218931 BSE Cash/CDS/FandO Member ID: 6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No : IN DP 418 2019 CDSL DP No. Service and online brokers have had to expand their offerings and cut costs to stay competitive. A heady belief that the losses will stop and the market will correct itself can lead to a total erosion of your capital. While both options promise to make you money, nowadays, trading is stealing the limelight. However, stocks are more forgiving. Collectively we are the biggest quant research community in the world with more than strategies shared through the forums, a vast library of public quant research. And if you’re looking for free options trades — here are the best brokers for that. Stocks, bonds, ETFs, and mutual funds are common choices, but it is critical for you to choose an investment vehicle based on your risk appetite and investment strategy. Discipline in trading is often hailed as the cornerstone of success in the financial markets, and it’s a topic rich with wisdom from those who have navigated them with skill. Check out ETRADE for its deep desktop and mobile platforms. NerdWallet Compare, Inc. Registered Address: 46, China Town, behind Gayatri mandir, Althan, Surat, Gujarat, India, 395007. You may refer to the following books to learn more –. Read Also: Is intraday trading possible without a Demat account. Hello,Is there a reason why you did not include “Trade Direct”, the online trading platform from BCV. It indicates a potential reversal in an upward trend, signaling a shift from bullish to bearish sentiment in the market. Moomoo Financial Inc. But he also lost all of his money on several occasions and ended up committing suicide. Capital appreciation in a rising stock market can be achieved easily. SEB is keen on fostering those reflections and we are as we have been historically always keen on adopting and spreading best practice principles. Guaranteed stops offer complete protection by ensuring positions close at the specified price. As such, many strategies are applicable to both, with the caveat that the time frames vary. Take your learning and productivity to the next level with our Premium Templates. When it is below 30%, the price is in the lower realm of where it has traded in the last 14 periods. As periodic receipts from invested securities are obtained, brokerage fees only consume a small portion of the entire income generation. In the case of indices, a 5% margin would require a $50 to open a position at $1000.

Mutual Funds

Please see the full pricing schedule for details about applicable charges. Com has all data verified by industry participants, it can vary from time to time. Ready to trade your edge. The information does not usually directly identify you, but can provide a personalized browsing experience. Learn about cookies and how to remove them. Swing trading carries a moderate level of risk compared to day trading and scalping. Trading is generally considered riskier than investing. Understanding Buying Call vs. These features, like financial monitoring, cash flow tracking, etc. Position trading involves holding a trade for a long period of time, whether this is weeks, months or even years. Although it’s a fee, you’ll pay this with all brokers, and eToro and Trading 212 are the cheapest out there. ” Investment Analysts Journal, vol. This typically involves. The term paper trade dates back to a time when aspiring traders practiced trading on paper before risking money in live markets—well before online trading platforms became the norm. Tel: 022 – 61169000/ 61150000, Fax no. 2Capital requirements for term trading related repo style transactions are the same whether the risks arise in the trading book as counterparty credit risk or in the non trading book as credit risk. In general, once your account has been coded as a pattern day trader account, a firm will continue to regard you as a pattern day trader, even if you don’t day trade for a five day period, because the firm will have a “reasonable belief” that you’re a pattern day trader based on your prior trading activities. The image uploaded below is a classic Inverted Head and Shoulder.

Our Download Free Trading Engine At your beck and call

Financial Industry Regulatory Authority. There are many strategies for trading stocks. To become a proficient trader, it’s essential to develop the habit of continuous market monitoring and analysis. Here’s how much tax you’ll be paying on your income from Bitcoin, Ethereum, and other cryptocurrencies. You can try uTrade Algos for free for 7 days. Brokers that offer paper trading let customers test their trading skills and build up a track record before putting real dollars on the line. The indicator is a series of dots placed above or below the price bars. It is amongst the best options trading books for traders or investors who want to understand futures, options, or any other financial derivatives. The broker’s core platform is available free in web and mobile versions, and it’s solid on the fundamentals, with watchlists, customizable charts and technical studies. The CFD you use specifies an amount of $1 per point of market movement, and you opt to trade 10 contracts. In a strong market when a stock is exhibiting a strong directional trend, traders can wait for the channel line to be reached before taking their profit, but in a weaker market, they may take their profits before the line is hit in the event that the direction changes and the line does not get hit on that particular swing. Blue line: Enter the trade after the price retested the neckline as support in the pink area. Review the Characteristics and Risks of Standardized Options brochure before you begin trading options. Instead, you put down a small deposit, known as margin. Arincen may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

What is insider screener?

Past performance is not necessarily indicative of future results. Per Friberg, Head of Financial Crime Surveillance at Trapets, explains insider trading, its legal implications, and best practices for companies to protect their business. What are the risks of trading. By receiving a higher option premium on the call sold than the cost of the call purchased, one achieves a net profit. Our guide to eleven of the most important stock chart trading patterns can be applied to most financial markets and this could be a good way to start your technical analysis. You can explore top trading courses to learn flexibly and then implement in real time. Whether the earnings are better or worse than analyst estimates may provide some clues as to the price direction of the stock. Watch lists aside, apps like TradeStation’s and Charles Schwab’s thinkorswim provide excellent stock chart tools and stock alerts functionality.

Stock Indices

The underlying market. Yes, the minimum price target for the formation is the distance from the previous low to the corrective high in the middle of the formation. 44 during the trading day, referred to as the intraday low, and reached a height of $178. A point to note is that a brokerage firm may impose a higher minimum maintenance requirement and limit pattern day trade to less than four times excess of maintenance margin. If you find that you want to exit a contract early before it expires, you can place another order to close your position, limiting losses or locking in profits. Generally, cookies may contain information about your Internet Protocol “IP” addresses, the region or general location where your computer or device is accessing the internet, browser type, operating system and other usage information about the website or your usage of our services, including a history of the pages you view. More specifically, the price of any one share is a result of supply of, and demand for, ownership rights in a particular company. For that reason, most educators try to condense the types of candlestick patterns into the most popular ones. Trading Books Brought to you by IG. A defined risk reward ratio helps implement sound money management. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. They allow you to invest in smaller portions of expensive stocks or funds, a great way to get started without a huge initial investment. The risk to the buyer is limited to the premium paid. VWAP bands, which are multiples of the standard deviation of VWAP, are used to identify potential support and resistance levels. Best for beginners who want to trade in a professional environment. These “affiliate links” may generate income for our site when you click on them. Failed double bottoms typically look like bear flags. Understand audiences through statistics or combinations of data from different sources. Margin is the minimum amount you must maintain in your trading account to enter into and hold positions.